One of the biggest (and most common) questions I get from future homeowners is: “How much house can I afford?” And while there’s no one-size-fits-all answer, there is a simple way to get a ballpark idea that actually makes sense for your life and budget. Here’s where to start:

Know Your Numbers

Before you fall in love with a house, you need to know what you’re comfortable spending each month. That means taking a good look at your household income and subtracting your monthly expenses—things like credit card payments, car loans, child care, and anything else you’re committed to.

What’s left over? That’s your starting point for what you could reasonably afford in mortgage payments, property taxes, and home-related costs.

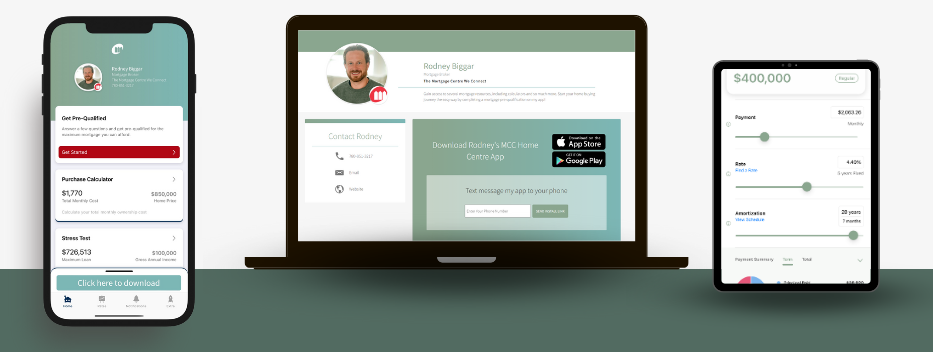

Use A Mortgage Calculator

This is where it gets fun! Pop into my mortgage calculator app (yes, it’s free and super easy to use) and enter that number to see what it equates to in mortgage dollars. Download my mortgage calculator app on your phone>> It’s packed with everything you need to make smart decisions:

Get pre-qualified without a credit check

Calculate your total cost of owning a home

Estimate your minimum down payment

See the income you’d need to qualify for a mortgage

Determine your max affordability based on your budget

Estimate closing costs specific to your location

For example, a client recently ran the numbers on my mortgage calculator and realized they could comfortably manage a $2,800/month mortgage payment. That translated to a mortgage amount of $419,919—a number that gave them clarity and confidence in their home search.

Want Help Crunching The Numbers?

If you’d rather skip the math and just have me walk you through it, I’m here for that too. Reach out anytime—I’ll help you figure out your ideal price range, what you qualify for, and what options are available.

Getting clear on your affordability is the first smart step toward homeownership. Let’s make sure it’s one you take with confidence. I’m a local mortgage broker, contact me today!