As a prospective homeowner, one of the most challenging questions to answer is ‘How much house can I afford?’ Although there is no single answer to this question, there are certain factors you can consider to help you determine how to make an informed decision about your ideal price range.

To start, the most important factor to keep in mind is your budget. Before purchasing a house, you should know exactly how much you can comfortably spend each month on a mortgage payment. In order to understand what your budget looks like, determine your total monthly household income.

Next, subtract your total monthly expenses, such as insurance, utility bills, credit card payments, car payments, child care costs and any other debts or obligations you have. The number leftover is what is available for a mortgage payment, property taxes and other expenses associated with owning a home.

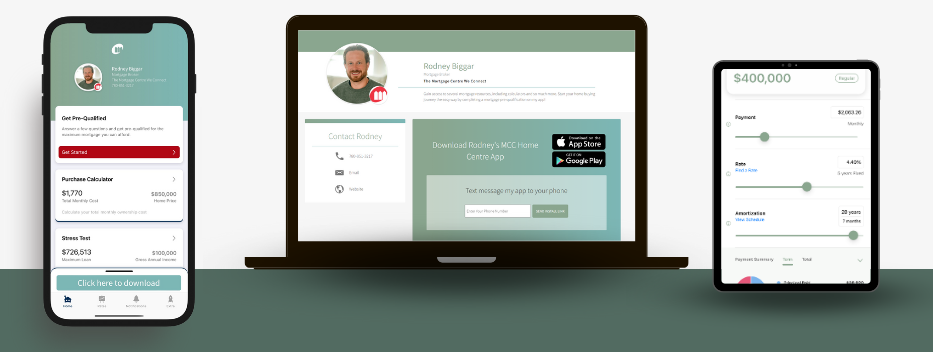

Lastly, download my mortgage calculator app on your phone to calculate what that payment equates to as a mortgage amount.

Below is an example of a client determining they can afford a $2,800 mortgage payment each month. This calculated a mortgage amount of $419,919.00.

This will help you figure out how much house you can afford. There are other factors to consider when applying for a mortgage, but this will put you in the ballpark. If you would prefer to have a mortgage broker determine what you can afford, please reach out to me and I would be happy to assist.